Corporate Governance Report

Fingerprint Cards AB (publ) (Fingerprints) is a Swedish public limited company listed on Nasdaq Stockholm and with registered office in Gothenburg in the County of Västra Götaland.

The corporate governance of Fingerprints is based on legislation and other regulations: the Swedish Companies Act, the Articles of Association, Nasdaq Stockholm’s Rulebook for Issuers, the Swedish Code of Corporate Governance, (the “Code”), other applicable laws and ordinances, and internal regulations.

Fingerprints strives to create long-term value for shareholders and other stakeholders. This involves ensuring an effective organizational structure, systems for internal control and risk management, as well as transparent internal and external reporting.

This Corporate Governance Report has been prepared in accordance with the Swedish Annual Accounts Act and the Code. Its primary purpose is to describe corporate governance within Fingerprints. For this purpose, the Report will only be used to a lesser extent to report information that ensues from applicable regulation. Fingerprint Cards’ auditors have read this report and an auditor's statement has been appended to it.

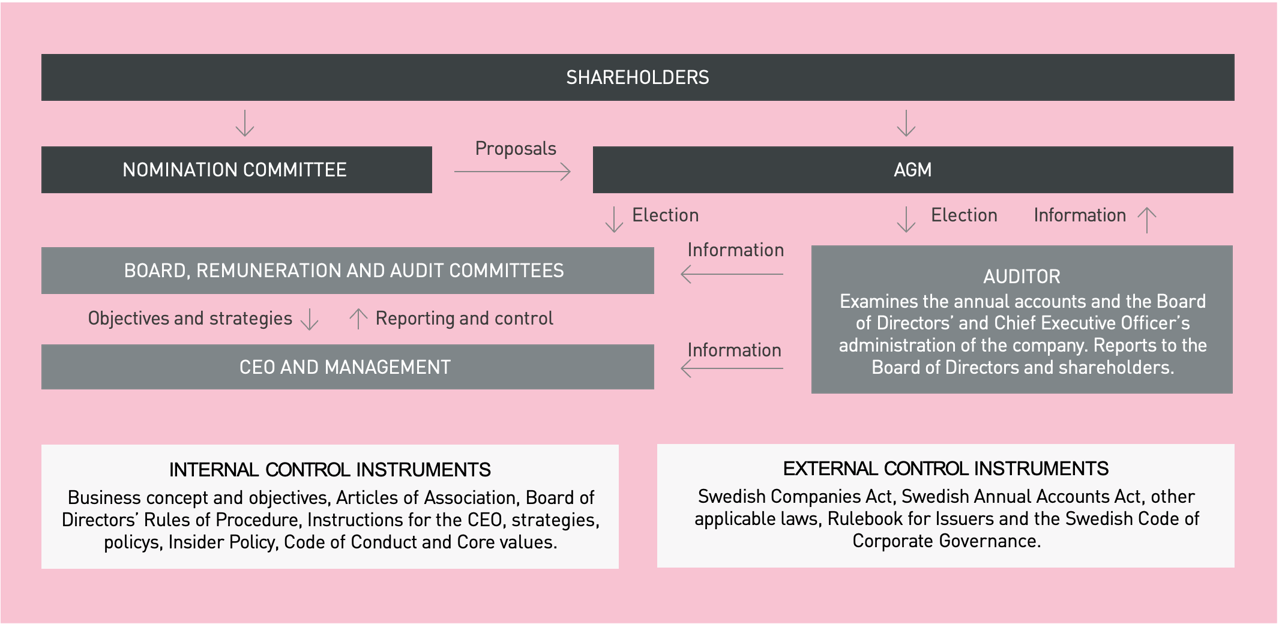

Segregation of duties

The shareholders exercise their influence at the General Meeting, which is the company’s chief decision-making body. Responsibility for the company’s organization and administration of the company’s affairs rests with the Board of Directors and the CEO in accordance with applicable laws and regulations, and the Board of Directors’ internal control instruments.

Shareholders

Fingerprints is a securities depository-registered company, and the company’s share register is maintained by Euroclear Sweden AB.

At year-end 2024, the company had 50,991 (50,553) known shareholders. The registered share capital was SEK 159,722,064, divided between 7,875,000 class A shares and 3,660,312,158 class B shares. Class A shares each carry ten votes and class B shares each carry one vote. Class A and B shares carry the same participating interest in the company and equal entitlements to dividends. Repurchased shares are in own custody and has no value in assets or in equity.

At year-end 2024, the ten largest shareholders held 16.1 percent of the votes in the Company.

Annual General Meeting

The Annual General Meeting (AGM) approves the Income Statement and Balance Sheet for the previous financial year for the Parent Company and the Group. The AGM also resolves on dividend and discharging the Directors and CEO from liability, elects the Board of Directors and the Chairman of the Board, and approves their fees, elects the auditor, and resolves on audit fees, and also deals with other statutory matters. Resolutions are taken on the Nomination Committee and guidelines for remunerating senior executives, and other proposals from the Board of Directors and shareholders.

Notice of shareholders’ meetings shall be made through an announcement in the Swedish Official Gazette and on the company’s website. Notification that the invitation has been issued is announced in the daily newspaper Svenska Dagbladet. Notice of AGMs are issued at the earliest six and the latest four weeks prior to the AGM. Meeting invitations are to contain information on the procedure for the notification of attendance and the closing date for notification, entitlement to participate in and vote, a numbered agenda with business for consideration, information on appropriation of profits and an outline of other proposals. Notice of an Extraordinary General Meeting (EGM), where an amendment to the Articles of Association is to be considered, are to be issued at the earliest six, and at the latest four, weeks prior to the EGM. Notifications of other EGMs are to be issued at the earliest six, and the latest three, weeks prior to the Meeting.

All shareholders recorded in the share register on the record date, and who have notified attendance on time, are entitled to participate in shareholders’ meetings, and vote in accordance with the shares registered. Shareholders can attend via a proxy that has been issued with power of attorney. However, the shares must still be registered with information regarding the proxy, and presentation of the power of attorney. In order to exercise voting rights at shareholders’ meetings, shareholders with nominee-registered holdings must temporarily re-register their shares in their own name, pursuant to the stipulations of the invitation to the Meeting.

Shareholders who wish to have a matter considered at the AGM shall provide a written proposal to investrel@fingerprints.com or to Bolagssekreteraren, Fingerprint Cards AB, Box 2412, SE-403 16 Gothenburg, no later than seven weeks before the AGM, to guarantee that the matter can be included in the invitation to the AGM.

Most resolutions at shareholders’ meeting are passed by a simple majority. In certain cases, the Swedish Companies Act stipulates resolutions require a qualified majority, for example resolutions on amending the Articles of Association, which require shareholders with at least two-thirds of both the votes cast and the votes represented at the Meeting to support the resolution. Resolutions regarding incentive programs require an even greater majority, with in certain cases, qualified majorities of up to 90 percent of the shares and votes represented at the Meeting.

Annual General Meeting 2024

The AGM for the 2023 fiscal year was held in Stockholm on 28 May 2024. The notice to the AGM was published on 30 April 2024. 70 shareholders, accounting for 17.2 percent of the votes and 7.6 percent of the shares, were represented at the AGM.

THE AGM PASSED RESOLUTIONS ON:

• Adopting the accounts for the 2023 fiscal year.

• Approving the appropriation of profits with the earnings carried forward.

• Discharging the Board of Directors and CEO from liability for the 2023 fiscal year.

• Approval of the remuneration report.

• That the number of Directors shall be five, with no deputies.

• Election of Directors, Chairman of the Board and auditor.

• Approval of Directors’ fees and fees to auditors.

• Guiding principles for remuneration of senior executives.

• Authorization of the Board of Directors to repurchase and transfer treasury shares.

• Establishment of long-term incentive program.

• Amend the articles of association.

• Subsequent approval of the Board of Directors’ decision on an issue of shares with preferential rights for existing shareholders.

Additionally, the AGM resolved to authorize the Board of Directors to, up until the next AGM, on one or more occasions, with or without deviation from the shareholders’ preferential rights, on new issues of Class B shares, warrants and/or convertibles entitling to subscription of Class B shares, corresponding to no more than twenty (20) per cent of the total number of outstanding shares in the Company.

More information on the 2024 AGM is available on Fingerprint Cards’ website: www.fingerprints.com.

Annual General Meeting 2025

The AGM will be held on 24 June 2025 in Celsiussalen, Citykonferensen Ingenjörshuset, Malmskillnadsgatan 46, 111 84 Stockholm, Sweden.

Nomination Committee

The Company is to have a Nomination Committee comprising four (4) members. During the year, the Chairman of the Board is to convene a meeting of the three (3) largest shareholders of the Company in terms of voting power and ask them to each appoint one representative who, in addition to the Chairman of the Board, will constitute members of the Nomination Committee. Should one of the three largest shareholders choose to waive their right to appoint a representative of the Nomination Committee, the shareholder who is next in line in terms of size is to be given an opportunity to appoint a member of the Nomination Committee.

The Nomination Committee may also decide, if this is regarded as appropriate, to appoint an additional representative of a group of major shareholders as a co-opted member of the Nomination Committee.

The Chairman of the Board is to convene the first meeting of the Nomination Committee. The member representing the largest shareholder in terms of voting power is to be appointed Chairman of the Nomination Committee, unless the members agree otherwise. The term of office of those appointed to the Nomination Committee extends until such time as a new Nomination Committee is appointed. The composition of the Nomination Committee is to be disclosed no later than six months before the AGM.

The Nomination Committee is to be constituted based on the largest shareholders in terms of voting power registered for the holder or known in some other manner as per the last banking day in August. If one or several of the shareholders who have appointed members of the Nomination Committee no longer belong to the three largest shareholders, their representative/s is/are to step down, whereupon the/those shareholder/s who has/have been added to three largest shareholders will be entitled to appoint a new representative. However, marginal changes that have occurred in the number of voting rights need not be taken into account, assuming that no special circumstances prevail.

If a member steps down from the Nomination Committee before its work has been completed, the Nomination Committee is to urge the shareholder who appointed such a member to appoint a new representative to the Nomination Committee without undue delay. Should this shareholder refrain from appointing a new representative, the right to appoint a new member of the Nomination Committee will accrue to the next largest shareholder in terms of voting power who is not represented on the Nomination Committee. Any changes to the composition of the Nomination Committee must be disclosed as soon as they occur.

The Nomination Committee is to draft proposals on the following issues for resolution by the 2025 AGM:

• Proposal concerning the Chairman of the Meeting

• Proposal concerning members of the Board

• Proposal concerning Chairman of the Board

• Proposal concerning auditor

• Proposal concerning the remuneration of Board members

• Proposal concerning the remuneration of the auditor

• Possible proposal to change the guidelines for appointing the Nomination Committee

Fingerprints’ Nomination Committee had the following members for the 2025 AGM:

• Sara Viktorsson (representing the shareholder Johan Carlström with company), chairman of the nomination committee

• Niels Henrik Balle (shareholder), member of the nomination committee

• Marie Almqvist (shareholder), member of the nomination committee

• Christian Lagerling, (Chairman of the Board of Fingerprint Cards AB), member of the nomination committee

Shareholders may submit proposals to the Nomination Committee. Proposals are to be sent by email to: investrel@fingerprints.com

Board of Directors and CEO

Pursuant to the Articles of Association, Fingerprints’ Board of Directors is to consist of four to ten Directors with a maximum of five deputies elected by the AGM for the period until the end of the following AGM. The Board of Directors and the Chairman of the Board are appointed at each AGM for the period until the following AGM, and accordingly, their term of office is one year.

Apart from the AGM, changes to the Board of Directors can be executed through an EGM resolution or by a Director choosing to resign his or her appointment in advance.

The 2024 AGM, held on May 28, 2024, resolved to re-elect Christian Lagerling, Alexander Kotsinas, Dimitrij Titov, Juan Vallejo and Adam Philpott as Board Members. Christian Lagerling was re-elected as Chairman of the Board of Directors.

Ahead of the AGM, the Nomination Committee considered three Directors of the Board to be independent of the Company and management, and that all five Directors were independent of major shareholders.

The Nomination Committee has applied item 4.1 of the Swedish Corporate Governance Code as diversity policy and continuously strives to meet the requirements of the Code on versatility, breadth and gender balance of the Board. With reference to the changes in the Board’s composition made at the previous Annual General Meeting, the Nomination Committee deemed that there should not be any changes to the Board composition this time and that the current composition is required for the Company’s ongoing transition process. The Nomination Committee deems that a more even gender distribution must be prioritized going forward.

The Board of Directors is responsible for Fingerprints’ organization and administration, in the interests of both the company and its shareholders. The Board must regularly evaluate Fingerprints’ financial situation and ensure that Fingerprints is organized so that its accounting, management of funds and the company’s other accounting circumstances are controlled satisfactorily. The Board appoints the CEO and decides on issues regarding strategic direction of operations and the company’s overall organization.

Each year, the Board adopts written Rules of Procedure that formalize the work of the Board and its internal segregation of duties, decision-making within the Board, the Board’s meeting schedule and the duties of the Chairman. In addition, the Board has issued documents including written instructions regarding the segregation of duties between the Board and the CEO.

The Board also approves policies and instructions for operating activities. Operating activities are managed by the CEO. The CEO regularly provides the Board with information on events that are significant to the company’s progress, results, financial position, liquidity or other information of such significance that the Board should be informed of.

Work of the Board of Directors in 2024

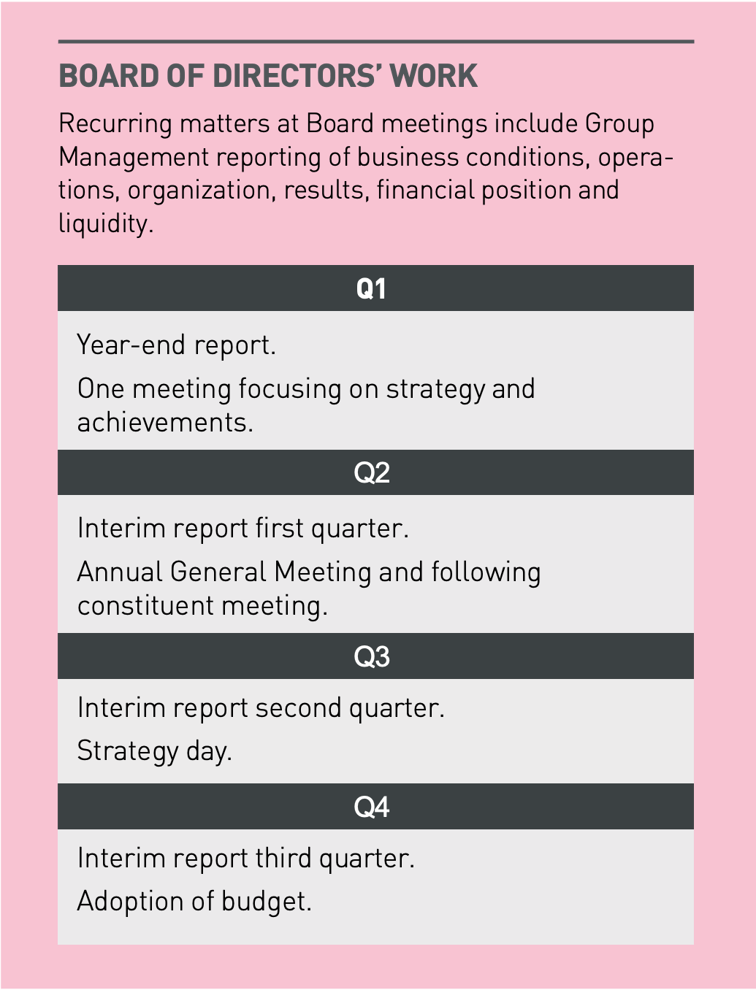

Pursuant to the current Articles of Association, the Board of Directors must meet on at least four scheduled occasions and one statutory meeting per year. Additional meetings can be held as required.

In 2024, there were 29 Board meetings. Scheduled agenda items at Board meetings during the year are Group Management’s reporting of business conditions, operations, organizational resources, results of operations, financial position and liquidity. Special Board meetings with a focus on strategy are held in the spring and autumn. During the autumn, and before Christmas, Board meetings consider the budget and business plan for the following year.

Board meetings are held quarterly to reach decisions on publications of interim, half-year and annual financial statements. Meetings to decide on convening notice, annual accounts, corporate governance documentation and other matters for business are held prior to AGMs. Senior executives of Fingerprints participate in Board meetings as required.

Remuneration Committee

The Remuneration Committee evaluates and consults on matters regarding remuneration and employment terms, and makes proposals and guidelines for remuneration of the CEO and senior executives for approval by the AGM. The Remuneration Committee must ensure that remuneration is commensurate with prevailing market conditions for corresponding executives in other companies, and accordingly, that the company’s offering to its employees is competitive. The CEO’s remuneration is approved by the Board.

Remuneration of other senior executives is decided by the CEO after consulting with the Remuneration Committee. In 2024, the Remuneration Committee’s members were the Directors Juan Vallejo (Chairman), Adam Philpott and Christian Lagerling.

During the fiscal year 2024, the Remuneration Committee met on two occasions.

Audit Committee

The Audit Committee’s duty is to support the Board on ensuring high quality and efficiency within internal controls, financial reporting and external audits. This includes reviewing interim reports and annual financial statements prior to publication, and considering all critical accounting issues and judgments regarding assessments of risk. The Audit Committee meets the external auditor at least once per year and reviews and monitors the auditors’ impartiality and independence, and identifies particularly whether the auditor is supporting the company on other services than auditing, and also provides support on proposals for AGM resolution and election of auditors.

In 2024, the Audit Committee’s members were Alexander Kotsinas (Chairman), Christian Lagerling and Dimitrij Titov. During 2024, the Audit Committee met on four occasions.

Auditor

The Articles of Association stipulate that Fingerprints must have one or two auditors with or without deputies, or one or two registered public accounting firms. The 2024 AGM elected BDO Mälardalen AB as auditor until the 2025 AGM. BDO Mälardalen AB appointed Johan Pharmanson as Auditor in Charge. Carl-Johan Kjellman, BDO Mälardalen AB, was also elected auditor until the 2025 AGM.

The duty of the auditor is to examine the company’s annual accounts and accounting records, and the Board of Directors’ and CEO’s administration on behalf of the shareholders. The auditor also conducts a summary review of one quarterly financial statement and issues opinions regarding the Board of Directors’ reporting in connection with such events as new share issues and decisions on warrant programs.

Each year, the Board of Directors meets the auditor for a report on whether the company’s organizational resources are structured so that bookkeeping, the management of funds and other circumstances can be controlled satisfactorily. The auditor has continuous contact with the Audit Committee and participates in at least one of the Audit Committee’s meetings during the financial year. The auditor attended the 2024 AGM on May 28.

Internal controls and risk management

The Swedish Annual Accounts Act stipulates that the Board of Directors shall submit a review of the material elements of the company’s systems for internal control and risk management over financial reporting yearly. The Board of Directors is responsible for the company’s internal controls, whose overall purpose is to ensure protection of the company’s assets, and thus its owners’ investments. The Board of Directors has adopted attestation instructions, a finance policy and other policy documents comprising instructions and procedures for operations that must be monitored regularly and reported. The attestation instructions include instructions regarding company signatories as well as roles and authorizations regarding decision making and the approval of agreements, investments, expenses and other expenditure. The Finance Policy sets mandates for investments, management of liquidity, currency hedging and credit issuance on sales. Sales are subject to credit insurance as far as possible, when this is viable and where credit insurance is granted only if there are good grounds to expect the borrower to fulfill its commitments.

Control environment

The fundamental control environment for financial reporting consists of guidelines and policy documents, including the Board of Directors’ Rules of Procedure and instructions for the CEO, and the segregation of duties and authorization regarding the organization of operations. Primarily, it is the CEO’s responsibility to establish in daily operations the control environment instructed by the Board of Directors. The CEO reports regularly to the Board according to established procedures. The auditor also submits reports from audits conducted.

Risk assessment

Risk assessment is an ongoing process encompassing the identification and management of risks that can impact operations and financial reporting. The primary risk within the auspices of financial reporting consists of material misstatement in accounting. Risk management is a part of operational processes and various methodologies are applied to ensure that risks are managed pursuant to regulation, instructions and procedures with the aim of making accurate disclosures.

Control activities

Control activities are designed to manage the risks that the Board and company management consider material to internal controls of financial reporting. Control activities designed to prevent, discover and rectify misstatement and deviations are evaluated. The segregation of duties and organization constitutes the structure for controls.

Follow-ups are conducted within each area of responsibility, and across all operations. Approvals and the segregation of authorization constitute the structure of control activities, as do clear rules for decisions regarding investments, sales, procurement and contracts. Control activities also proceed from the business concept, strategies and objectives, and mission-critical activities. A high level of IT security is a prerequisite for good internal controls over financial reporting. Fingerprints’ IT strategy emphasizes security and functionality, with security being more important because without security, functionality is compromised.

External financial reporting with the ensuing controls is conducted on a quarterly basis, and internal financial reporting on a monthly basis. The Board of Directors follows up on internal control in connection with the financial reports, primarily in the Audit Committee. The Audit Committee regularly reviews the company's control environment, including financial processes, regulatory compliance and reporting procedures. This is primarily done through a review of audits and follow-up of identified areas for improvement. The Committee has an ongoing dialogue with the company's CFO and the external auditor to ensure that internal controls are appropriate and well-functioning. In addition to this, the management, if necessary, keeps the board informed about the situation and activities in special Board memos. Financial controls are based on business plans that are broken down to yearly budgets. Budgets are reviewed and constitute forecasts and supporting data for monitoring against results achieved. Reporting involves analyses and comments on progress in relation to established objectives. Development projects are managed through ongoing project monitoring with reporting of subprojects. Efforts made and expenditures incurred are related to plans and budgets, and expected remaining project expenditure until project completion are also reported.

Operational control is supplemented by monitoring of the quality and performance of suppliers, customers and internal processes. Monitoring of liquidity and cash flow is conducted on an ongoing basis with updates of forecasts and the resulting liquidity planning. The continuous analysis of financial reports at various levels are central for ensuring that financial reporting does not contain material misstatement. Control activities and the division of various functions are embedded throughout the financial reporting process.

The company has no dedicated internal audit function, as the board has made the assessment that internal functions and processes within finance, law and quality meet the needs for review and control.

Remuneration to the Board of Directors

The 2024 AGM resolved on a total fixed Directors’ fee of SEK 1,855,000, of which SEK 675,000 to the Chairman and SEK 295,000 to each member. Fees for committee work of SEK 450,000 was allocated as follows: Audit Committee: SEK 135,000 to the Chairman and SEK 70,000 to the other members. Remuneration Committee: SEK 85,000 to the Chairman and SEK 45,000 to the other members. The remuneration to the Board of Directors per member is unchanged compared to the previous term of office. Directors receiving a salary from Fingerprints are not eligible for Directors’ fees. Directors that join the Board in the year receive fees in relation to the remaining period until the following AGM.

| Independent in relation to: | |||||||||

|---|---|---|---|---|---|---|---|---|---|

| Name | Function | From | To | Committee | Company | Larger shareholders | Närvaro möten 2024 | Styrelse-arvode 2023/24 (Tkr) | Utskottsarvode 2022/23 (Tkr) |

| Christian Lagerling | Styrelse-ordförande | 9/20/22 | – | Audit Committee | Nej | Ja | 29/29 | 675 | 115 |

| Alexander Kotsinas | Member | 4/20/17 | – | Audit Committee | Ja | Ja | 27/29 | 295 | 135 |

| Dimitrij Titov | Member | 4/20/17 | – | Audit Committee | Ja | Ja | 28/29 | 295 | 70 |

| Juan Vallejo | Member | 5/29/18 | – | Remuneration Committee | Ja | Ja | 28/29 | 295 | 85 |

| Adam Philpott | Member | 5/24/23 | – | Remuneration Committee | Nej | Ja | 29/29 | 81 | 12 |

| Mario Shiliashki | Member | 5/24/23 | 5/28/24 | Remuneration Committee | Ja | Ja | 4/10 | 295 | 45 |

Remuneration guidelines of senior executives

The 2024 AGM approved the Board of Directors’ proposal regarding guiding principles for remuneration of senior executives. The guidelines are presented in the Administration report.

Articles of Association

The Articles of Association stipulate the company’s operations, the number of Directors and auditors, procedure for convening shareholders’ meetings, matters for consideration at the AGM and where meetings are held, as well as share classes and preferential rights. The Articles of Association are available at the website: www.fingerprints.com.

Information and communication

Fingerprints’ policies and guidelines are especially important for accurate accounting, reporting and corporate communication. Information shall increase knowledge of Fingerprints, increase confidence in Fingerprints, its management and employees, and promote business activities. A Corporate Communication Policy is in place for communication with internal and external parties, containing guidelines for the company’s corporate communication. The purpose is to ensure compliance with the communication obligation in an accurate and comprehensive manner.

Monitoring

Compliance with the Rules of Procedure, instructions, policies and procedures are monitored by the Board of Directors and Group Management. Board meetings consider business conditions and the financial position. The Board of Directors reviews financial statements and decides on publication of financial reports. The Board of Directors appraises its own work, and the CEO’s work, yearly. A Board evaluation has been carried out by having members of the Board answer a number of questions about the Board's work. The answers were then compiled and reported by the Chairman of the Board and discussed by the Board. The Nomination Committee has thereafter in order to make correct assessments of the Board’s composition, among other things, taken part of and, together with the Chairman of the Board, gone through the board evaluation and the Board’s work as well as the Chairman of the Board's statement of the Company's operations, objectives and strategies. The CEO's work is evaluated on an ongoing basis by the Board. In addition, a formal CEO evaluation is normally carried out at least annually, in parallel with the board evaluation.

At least one interim or half-year report, and all annual financial reports are audited. The CEO provides monthly reports to the Board of Directors, involving all parts of operational functions.

Management meets frequently and monitors business development, financial performance and position, and significant events.

The Board of Directors meets the auditor during the year to review the audit of internal controls and other assignments. Forecasting and budgeting work is conducted continuously with a rolling, forward-looking forecast based on updated information on sales, procurement, operating expenses and product development and technology development.

Board of Directors

Gothenburg, on the date stated in the electronic signatures.