Administration Report

The Board of Directors and the Chief Executive Officer (CEO) of Fingerprint Cards AB hereby present the Annual Accounts for the 2024 fiscal year.

Fingerprints’ operations

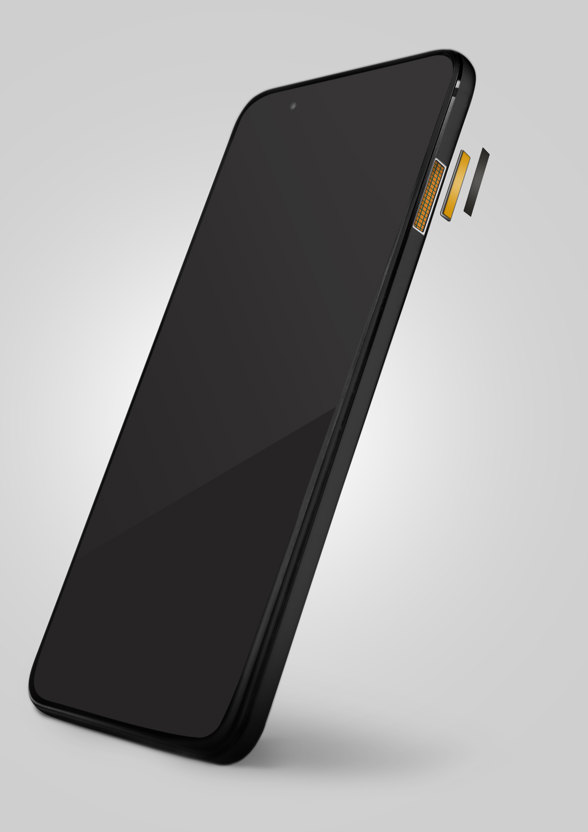

Fingerprints’ solutions are integrated into close to two billion devices and applications and are used billions of times every day. Fingerprints develops biometric systems comprising sensors, microcontroller (MCU), algorithms, software and packaging technologies, and the company’s product development has resulted in high security products and seamless user experience. The use of biometrics is increasing in several application areas, and Fingerprints’ solutions can be found in e.g., FIDO keys, crypto wallets, and payment cards.

Group and Parent Company

The annual accounts cover the fiscal year January 1–December 31, 2024. Fingerprint Cards AB (Publ) (Corp. Reg. No. 556154-2381) is the Parent Company of a Group including 16 subsidiaries.

The Parent Company has its registered office in the Municipality of Gothenburg in the county of Västra Götaland. The company’s shares are listed on Nasdaq Stockholm since 2000.

SIGNIFICANT EVENTS DURING THE YEAR

-

Fingerprints took decisive steps to reinforce its leadership team, ensuring the company is well-positioned to drive innovation and execute its transformation strategy. As part of this effort, we welcomed key leaders who bring extensive industry expertise and strategic vision:

-

Fredrik Hedlund was appointed Chief Financial Officer. Fredrik’s experience spans more than 25 years in finance and operational leadership roles at major global corporations like Nielsen and General Electric, as well as in startups.

-

David Eastaugh was appointed Chief Strategy and Technology Officer. David is a technology visionary in the fields of identity, data, and combating financial crime and fraud, with a diverse background that includes experience in startups, scale-ups, consulting, and corporations.

-

Fredrik Ramberg was named Chief Product Officer (CPO). Since first joining Fingerprints in 2014, Fredrik Ramberg has held several senior leadership roles, including as Head of R&D for Payment and Access.

-

-

In April, Fingerprints announced a partially guaranteed rights issue of up to approximately SEK 310 million, an agreement on early redemption of its convertible bonds, and a bridge loan of SEK 60 million.

-

In December, in order to confidently enable the completion of the transformation plan and in turn achieve stability and stronger prospects for the future of the Group, Fingerprints announced a partially guaranteed rights issue of up to approximately SEK 160 million and a bridge loan of SEK 40 million.

Earnings trend

The Group’s revenue for the period January–December 2024 totaled SEK 403.2 M (705.4), corresponding to a decrease of 43 percent compared with 2023. The period was characterized by intense price competition in the Mobile product group. We focused on implementing a phase-out of our loss-making operations in the Mobile product group to safeguard our company's financial health and future viability. The on-going wind-down of the PC product group also impacted negatively on revenue.

Gross profit for the period January-December 2024 was SEK 45.6 M (89.6) and the gross margin was 11.3 percent (12.7). Gross profit in the period January-December 2024 was negatively impacted by SEK 81.4 M in planned non-cash depreciation of previously capitalized R&D expenses. Gross margin excluding this effect was 31.5% (20.8% in the corresponding period 2023). The reduced sales volumes, combined with increased price competition within the Mobile product segment, had a negative impact on profitability in 2024.

The operating result for the year was SEK -522 M (-320). Exchange-rate effects are recognized in operating profit under the item Other external income, alternatively under Other external expenses. The result before tax for the year was SEK -567 M (-376), while income tax of SEK -121 M (pos: 36) were recognized. In total, the Group’s full-year result amounted to SEK -644 M (-340). The Group’s earnings per share for 2024 were SEK -0.24 (-0.31).

Current factors of uncertainty

Fingerprints, like most other companies, is affected by the general economic development in the world, for example through higher loan interest rates and weaker demand for consumer electronics. Fingerprints’ current assessment is that the company is not materially impacted directly by the war between Russia and Ukraine, nor by any other ongoing armed conflicts. Political developments, including increased trade tensions, tariffs, or trade restrictions, may impact our operations and supply chains. We closely monitor developments related to increased trade tensions and maintain readiness to take appropriate action to mitigate potential negative effects.

Financial position

Shareholders’ equity amounted to SEK 277 M (692) and the equity/assets ratio to 65 percent (64).

Fixed assets decreased to SEK 296 M (694). The share of fixed assets in relation to total assets increased to 70 percent (64). Inventories decreased to SEK 48 M (133) and outstanding accounts receivable declined to SEK 56 M (121).

Accounts payable at year-end amounted to SEK 40 M (103) and other current liabilities amounted to SEK 87 M (168).

Long-term liabilities amounted to SEK 3 M (79). Cash and cash equivalents amounted to SEK 12 M (110) at year-end.

Investments, depreciation/amortization and impairment losses

During 2024, net investments totaled SEK 12 M (46). Of this, SEK 12 M (47) was invested in capitalized development and intangible fixed assets, SEK 0 M (0) was invested in property, plant and equipment and SEK 0 M (1) was received in financial fixed assets. Total depreciation/amortization according to plan and write-downs amounted to SEK -378 M (-78) in 2024. Of this, amortization of intangible fixed assets accounted for SEK -83 M (-61), write-downs for SEK -288 M (-5) and depreciation of property, plant and equipment for SEK -1 M (-1). Right-of-use assets were depreciated by SEK -6 M (-11).

In total, the carrying amount of intangible fixed assets in 2024 was SEK 230 M (505), while property, plant and equipment amounted to SEK 2 M (3) and right-of-use assets pertaining to the leasing of premises amounted to SEK 8 M (14).

Cash flow

Cash flow from changes in working capital components was positively impacted by a reduction in capital tied-up in current receivables in the amount of SEK 84 M (25), and by a decrease in inventories in the amount of SEK 35 M (209). Cash flow from operating activities amounted to SEK -208 M (-88).

Cash flow from investing activities was SEK -12 M (-46). Cash flow from financing activities was SEK 118 M (-26).

The overall net change in cash and cash equivalents for full-year 2024 was SEK -98 M (-164). Net debt amounted to SEK 8 M at year-end 2024, compared with net debt of SEK 5 M at the end of 2023. Interest-bearing liabilities at the end of 2024 amounted to SEK 14 M, comprising the partial disbursement of a SEK 40 M bridge loan. In addition, lease liabilities pertaining to office premises amount to SEK 6.8 M (12.8), recognized in accordance with IFRS 16.

Operating segments and product groups

Revenue is reported by Product Group: Access, Payment, Mobile and PC. Fingerprints has implemented a functional organization and governance model to support its Biometric Platform Strategy. This change means that the company from January 1, 2024 no longer manages the business in separate operating segments, and no longer reports results for the previous operating segments Asia, Rest of World and New Business.

Access

Biometric solutions for Access – biometric access control – is a fragmented but growing market that includes key applications such as Logical Access (devices such as FIDO tokens and PIV/FIDO cards), Physical Access (access cards and smart locks), Physical Crypto Wallets, Smartlocks (door locks and padlocks for secure physical entry), and IoT (storage, safes, alarms, etc.). Fingerprints offers software and biometric sensors specifically customized for Access products, comprising both modules for fingerprint recognition and touchless solutions based on iris recognition.

While revenue in the Access product group decreased by 11 percent compared to 2023, we saw positive momentum throughout 2024, with revenue growing sequentially every quarter. The positive trend in Access is mainly driven by an increased demand for biometric authentication for logical access control, especially in FIDO-certified products. To capture these opportunities, Fingerprints introduced FPC AllKey in 2024, a versatile, high-security biometric solution for various devices, from smart door locks to cryptocurrency wallets, which simplifies integration, reduces risk, and accelerates time-to-market for device manufacturers. This launch strengthens Fingerprints position in the access control market and broadens our addressable market in secure authentication.

Iris recognition is also suitable for certain applications within Access, such as touchless entry and exit control systems in public environments, something that came into sharper focus as a result of Covid-19. Companies and organisations are also showing an increased interest in access cards and security keys with fingerprint sensors, as the same card or key can be used to enable uniform, secure access to computers and systems, as well as to physical spaces.

Moreover, the automotive industry is another area where Fingerprints foresees considerable potential. For example, Driver Monitoring Systems (DMS) are becoming mandatory, requiring hardware adaptable for iris recognition to enhance safety and efficiency, hence the company is focusing on enabling its iris recognition technology in this area. At the beginning of 2025, we announced an agreement to license our iris recognition technology to the Swedish company Smart Eye for a total consideration of up to SEK 50 million, entering a strategic partnership to enhance security and user experience in Automotive and Enterprise. Smart Eye is the automotive market leader in camera-based sensing for in-vehicle applications, with more design wins and OEM customers than any other supplier. Starting in 2026, every new car in Europe must be equipped with a Driver Monitoring System (DMS) to detect driver distraction, accelerating the technology globally. Biometric authentication is an important emerging capability in automotive, with camera-based methods the most secure and intuitive solution.

Payment

Fingerprint sensors for payment devices, including payment cards and wearables, represent a considerable potential market and is an important growth area for Fingerprints. Fingerprint authentication replaces PINs and signatures, reducing fraud risks. At the same time, biometric data remains securely stored on the card. For card manufacturers seeking secure, seamless solutions, Fingerprints offers certified biometric systems for payment cards that seamlessly integrate into existing ecosystems by delivering turnkey solutions through strategic partners that enhance security, simplify integration, and enable cost-effective production.

Although revenue in the Payment product group decreased by 37 percent compared to 2023, Fingerprints maintains a market leading position with very high performance in terms of transaction speed, power efficiency and security, as proven in several commercial launches by banks in different parts of the world. In 2024, we continued to innovate in partnership with key players in the payment ecosystem. Infineon’s SECORA™ Pay Bio payment card solution, integrating Fingerprints’ FPC1323 sensor, is a great example. It is now fully certified for use in Visa and Mastercard payment cards, marking a significant milestone in the companies’ missions to provide secure and seamless payments.

The T-Shape sensor module, part of Fingerprints’ FPC1300-series, of which we have shipped more than one million units, enables cost-effective production of biometric payment cards. The biometric sensor has been tailored to allow easy integration using standard automated manufacturing processes. This ensures reduced waste, optimizes production capacity and throughput and lowers related manufacturing costs.

Mobile

In 2024, Fingerprints focused on winding down its loss-making operations in the Mobile product group in order to safeguard the company’s financial health and future viability.

As part of the Mobile product group wind-down, Fingerprints entered into an exclusive partnership agreement with Egis, a biometric sensor solution provider, covering patent and technology licensing and conditional Mobile asset acquisitions, to enable Egis to start to integrate Fingerprints’ Mobile products and technology with Egis’ existing mobile platform. Furthermore, the partnership with Egis enabled a faster, more efficient wind-down of Fingerprints’ Mobile business and inventory depletion, as well as providing continued employment opportunities at Egis for some of Fingerprints’ former Mobile-dedicated staff. As a result of the exclusive partnership agreement with Egis, Fingerprints has thus far received SEK 15 million in cash payments. While these payments are not material, the agreement with Egis entails future opportunities for Fingerprints to generate additional cash payments and royalties for development work.

Sales in Mobile amounted to SEK 254 M in 2024, a 51-percent decrease compared to 2023. In the fourth quarter, Mobile revenue had decreased to SEK 3 M, signifying that the wind-down was in its final stages by the end of 2024.

PC

As the the PC market is commoditizing like Mobile, we will wind down this product group, achieving further cost reductions and entirely exiting China.

Revenue in the PC product group decreased by 25 percent, to SEK 73 M, partly due to the lifecycle maturity of certain models incorporating our technology. This has driven customers to diversify their supplier base, further impacting Fingerprints’ market share – particularly as a small-cap company following the Mobile wind down. Securing new PC projects has proven to be both capital- and time-intensive, further underscoring the unsustainability of the product group. In addition, we see that the PC market is commoditizing like Mobile. Against this backdrop, Fingerprints started the wind-down of the PC product group in 2024, in order to achieve further cost reductions and exit the Chinese market entirely.

Effect of of the wind-down of the Mobile and PC product groups

During the January-December 2024 period, the wind-down process has had the following financial effects:

Mobile

-

An inventory write-down amounting to SEK 54.7 M and a SEK 7.1 M impairment of capitalized R&D.

-

As a result of the exclusive partnership agreement with Egis Technology in the Mobile area, Fingerprints has thus far recognized SEK 39.7 M in revenue.

-

SEK 28.6 M in costs related to restructuring measures.

-

Revenue positively impacted by a reversal of accrued marketing incentives to customers in the Mobile area, amounting to SEK 24.7 M.

PC

-

A SEK 32.3 M write-down of capitalized R&D projects in the PC area.

Finance Policy

Fingerprints’ Finance Policy regulates and clarifies responsibilities, and states guidelines in specific areas within financing, credit insurance, investment and currency management with the aim of supporting operations, managing financial risks and controlling their impact on financial position, results of operations and cash flow. The most important net currency flow is in USD, whereupon a significant portion of Fingerprints’ finance activities were in formulating a strategy for selling USD and buying SEK. The increased net surplus from sales, which is denominated in USD, and the increasing operating expenses that are predominantly denominated in SEK generate a continuous need to convert USD to SEK. Materials procurement, manufacturing and sales are essentially denominated in USD only. Fluctuations in other exchange rates have an insignificant impact on earnings. According to the Finance Policy, currency hedging using derivative instruments is not permissible. See Note 23, for more information on financial risks.

Organization and coworkers

There were 53 (159) employees as of December 31, 2024 comprising 39 (111) men and 14 (48) women. Including employees and consultants, Fingerprints employed a total of 71 (185) people on December 31, 2024.

Research and development operations

Through continuous initiatives to enhance biometric technology, Fingerprints has attained leadership in fingerprint recognition. In 2024, engineers accounted for approximately 60 percent of the Group’s total workforce.

Expenditure for technology development is partly recognized as a cost in the Consolidated Statement of Comprehensive Income (Parent Company Income Statement) under the development costs heading, and partly through capitalization in the Consolidated Statement of Financial Position (Parent Company Balance Sheet), and capitalized development expenditure, under intangible fixed assets.

Capitalization is effected after an assessment of factors such as each project’s commercial, financial and technical potential, its future value for the Group, disposal over rights to the product/solution, the potential for completing development and the presence of a market for the product.

The rate of amortization is determined on the basis of the technical and commercial lifespan of the product/solution related to the existing market. Accordingly, the amortization term varies between products and projects.

In 2024, the Group’s expenditure on technological development and patents amounted to SEK 121 M (164), of which SEK 12 M (47) was capitalized in the Consolidated statement of financial position and the remaining SEK 109 M (117) was expensed in the Consolidated statement of comprehensive income.

Sustainability Report

In accordance with Chapter 6, Section 11 of the Swedish Annual Accounts Act, Fingerprints has decided to prepare a statutory Sustainability Report as a separate document from the Annual Report.

Fingerprints’ Sustainability Report, which also constitutes Fingerprints’ statutory Sustainability Report, satisfies the Swedish Annual Accounts Act’s requirements for sustainability reporting. The report is presented on pages 41-51.

Ownership structure

In 2024, the number of shareholders increased slightly to 50,991 at year-end from 50,553 at the beginning of the year.

Ownership structure

| Shares and share capital, % | Votes at year-end, % | |||

|---|---|---|---|---|

| Owner | 2024 | 2023 | 2024 | 2023 |

| Velociraptor LTD | 0.2 | 1.3 | 2.1 | 11.8 |

| No of shares | No. of votes | |||

| Share class | 2024 | 2023 | 2024 | 2023 |

| A | 7,875,000 | 7,875,000 | 78,750,000 | 78,750,000 |

| B | 3,660,312,158 | 589,014,670 | 3,660,312,158 | 589,014,670 |

| Total | 3,668,187,158 | 596,889,670 | 3,739,062,158 | 667,764,670 |

Expectations regarding future performance

Reduced sales volumes, combined with increased price competition within the Mobile product segment, had a negative impact on profitability in 2024. The company continued to diversify its revenue streams to higher-margin areas outside of Mobile and PC. Looking ahead, we are focused on our Smartcard (Payment) and Access solutions, including iris recognition technology, to drive sustained growth. Completing our Mobile and PC exit strategy will optimize costs and improve profitability. We will continue expanding our digital identity solutions, reinforcing our leadership in secure authentication.

Seasonal variation

Fingerprints’ revenue mix has shifted towards the Access and Payment areas due to the wind-down of the Mobile and PC product groups. In the company’s core Payment and Access business, the second half of the year tends to be the strongest in terms of volume.

Remuneration of the Board of Directors

The 2024 Annual General Meeting (AGM) resolved on a total fixed Directors’ fee of SEK 1,855,000, of which SEK 675,000 to the Chairman of the Board and SEK 295,000 per Director to the other Directors. In addition, fees for committee work will be payable in an amount of SEK 450,000, to be distributed as follows: Audit Committee: SEK 135,000 to the Chairman and SEK 70,000 to other members. Remuneration Committee: SEK 85,000 to the Chairman and SEK 45,000 to other members.

Executive remuneration guidelines

The 2024 AGM decided in accordance with the proposal that the Remuneration Committee shall prepare guidelines for compensation and employment terms for the CEO and other senior executives and put forward proposal to the Board for decision. The guidelines are valid for four years.

Introduction

The Executive Management is defined as the Chief Executive Officer and other members of the management team. The purpose of these guidelines is to clarify the compensation as decided.

The guidelines are forward-looking, i.e. they are applicable to remuneration agreed, and amendments to remuneration already agreed, after adoption of the guidelines by the annual general meeting. The general meeting has the right to agree on additional remunerations outside of these guidelines.

Remuneration committee

The remuneration committee evaluates and considers matters regarding remuneration and employment terms and prepares proposals for guidelines for compensation to the CEO and executive management. The Board of Directors shall evaluate a proposal for new guidelines at least every fourth year and submit it to the AGM. The guidelines shall be in force until new guidelines are adopted by the general meeting. The Remuneration Committee should ensure that remuneration is commensurate with prevailing market conditions for corresponding executives in other companies, and accordingly, that the company’s offering to its employees is competitive. The CEO’s compensation is approved by the Board of Directors. Compensation to other senior executives is decided by the CEO after consulting with the Remuneration Committee. The members of the remuneration committee are independent of the company and its executive management. The CEO and other members of the executive management do not participate in the board of directors’ processing of and resolutions regarding remuneration-related matters in so far as they are affected by such matters.

Promotion of the company’s business strategy, long-term interests and sustainability

Fingerprint Cards aims to attract, engage, develop and retain the right people to drive our business result in line with the company’s business strategy. In order to support this, the design and implementation of our remuneration structure shall be performance based; affordable; sustainable; market driven and clear. Compensation shall reflect the scope and complexity of each role, as well as the actual performance of the individual. Fingerprint Cards does not tolerate any form of discrimination and we perform annual reviews to make sure we do not have any salary misalignments based on any discriminating factors such as gender, transgender identity or expression, ethnicity, religion or other belief, disability, sexual orientation and age.

Variable remuneration covered by these guidelines shall aim at promoting Fingerprint Card’s business strategy and long-term interests, including its sustainability.

For more information regarding the company’s business strategy, please see www.fingerprints.com.

Remuneration under employments subject to other rules than Swedish may be duly adjusted to comply with mandatory rules or established local practice, taking into account, the overall purpose of these guidelines.

Remuneration principles

Performance-based

There shall be a strong link between performance (individual - and business result) and compensation. Base salary will depend on the employee’s performance against objectives, development progress and living our company values.

Competitive and sustainable

We must create value to secure our present and future capability to pay competitive compensation and we must earn the means for our compensation. It is important to have a balance between our company earnings and our compensation levels.

Market driven

Our salaries shall reflect the scope and complexity of the work. It is our objective to compare our base salaries with relevant market data for the applicable country. Each country forms its own market.

The remuneration principles are also applicable to the rest of the employees at Fingerprint Cards.

In the preparation of the board of directors’ proposal for these remuneration guidelines, salary and employment terms for employees of the company have been taken into account by including information on the employees’ total income, the components of the remuneration and increase and growth rate over time, in the remuneration committee’s and the board of directors’ basis of decision when evaluating whether the guidelines and the limitations set out herein are reasonable.

Total remuneration

The total remuneration to Executives consists primarily of monthly base salary, short-term incentives, pension, and insurances. If decided in the general meeting, the total remuneration may also include – irrespective of these guidelines – long term incentives.

Short Term Incentive (STI)

Short Term Incentives shall be linked to predetermined and measurable criteria. The Short-Term Incentives include company measures such as Revenue, Operating Profit and Cash Balance. For Executives, 80-90 per cent of the STI is based on company measures, and 10-20 per cent is based on individual performance, with predetermined targets on an annual basis. The criteria shall be designed so as to contribute to Fingerprint Card’s business strategy and long-term interests, including its sustainability.

The satisfaction of criteria for awarding STI shall be measured over a period of one or several years. The variable cash remuneration may amount to not more than 100 per cent of the total fixed base salary during the measurement period.

For financial objectives, the evaluation shall be based on financial information made public by the company.

Pension

Pension plans are based on defined contribution models, where a premium is paid amounting to not more than 30 per cent of the Executive’s fixed annual base salary.

Insurances

Executives are provided insurance coverage in accordance with local market practice. Such benefits shall be customary and be of limited amount.

Termination of employment

Upon termination of an employment, the notice period may not exceed six months. During the notice period, the executive will continue to receive full base salary and other employment benefits. Upon termination by the company, severance payment could be paid and may not exceed twelve months’ base salary. When termination is made by the executive, the notice period may not exceed six months, without any right to severance pay.

Additionally, remuneration may be paid for non-compete undertakings. Such remuneration, if applicable, shall amount to a maximum of 60 per cent of the monthly base salary at the time of termination of employment, unless otherwise provided by mandatory collective agreement provisions.

The Board of Directors’ right to deviate from the remuneration guidelines

In certain cases the Board of Directors may decide to deviate from these guidelines, in part or in total, if there are special reasons to do so in an individual case and a deviation is necessary to fulfill the company’s long term interest, including in relation to sustainability, or to safeguard the company’s financial position. As set out above, the remuneration committee’s tasks include preparing the board of directors’ resolutions in remuneration-related matters. This includes any resolutions to derogate from the guidelines.

Description of significant changes and how the shareholders' views have been taken into account

There have been no significant changes to the proposed new guidelines in relation to the remuneration guidelines adopted by the Annual General Meeting 2020. There have been no material comments on the remuneration guidelines from shareholders.

Description of the work of the board of directors during the year

Scheduled agenda items at Board meetings during the year are Group Management’s reporting of business conditions, operations, organizational resources, results of operations, financial position and liquidity. During the autumn, and before Christmas, Board meetings consider the budget and business plan for the following year. The Board met on 29 occasions in 2024. A more detailed description of corporate governance in 2024, including regulations, general meetings, the Nomination Committee, the composition and work of the Board and internal governance processes and internal control, is presented in the separate Corporate Governance Report.

2025 Annual general meeting

The AGM will be held on Tuesday, June 24, 2025.

Proposal for appropriation of the company’s profit

The following funds are at the disposal of the AGM, SEK:

| Share premium reserve | 777,295,305 | ||

| Accumulated profit or loss | -417,268,299 | ||

| Net profit/loss for the year | -422,171,027 | ||

| Total | -62,144,021 |

The Board of Directors proposes that net profit for the year, non-restricted reserves, as well accumulated profit or loss be appropriated as follows:

To be carried forward: SEK -62,144,021.

Regarding the company’s results of operations and financial position in other respects, the reader is referred to the following financial statements, with the associated notes.

Events after the balance sheet date

See Note 27.